On November 25, 2019, Calgary City Council will meet to discuss the municipal budget for 2020. Property taxes are one of the largest sources of funds for the City, and therefore will be a key part of the budgeting process. Non-residential property taxes, those paid by Calgary’s business community, will be particularly critical for this round of budget planning.

Calgary’s businesses have borne the brunt of an increasing tax burden caused by three key factors.

- The first is the steady rise of non-residential property taxes over the last few years.

- The second is the high vacancy rates in the downtown core.

- And the third is structural property tax issues that have gone unaddressed.

Adding to that is the Business Tax Consolidation undertaken by the municipal government into non-residential property taxes and we see a layering of costs on Calgary businesses.

In this month’s Dive Deeper, we outline how property taxes are calculated, where Calgary currently stands, and what the Chamber has been advocating for to ensure certainty for Calgary’s business community.

What is the difference between municipal and provincial property taxes?

Any property tax bill in Calgary usually includes a municipal and provincial portion. The City of Calgary bills and collects municipal property taxes and property taxes on behalf of the provincial government. The provincial tax collected is allocated exclusively to provincial services. Here, we will focus only on the municipal portion for your property taxes.

How important are property taxes to the City’s budget?

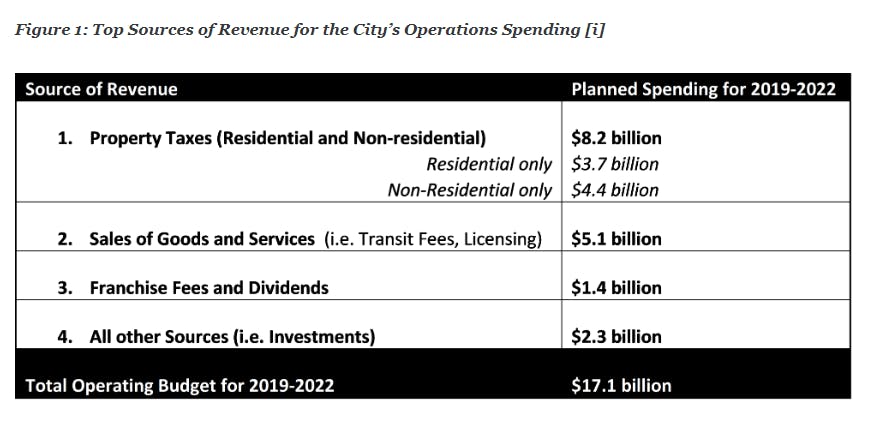

Property taxes, residential and non-residential combined, are the largest source of revenue for the City of Calgary. As reflected in the City’s One Calgary plan, which covers operating and capital budgets for 2019 through 2022, the City will need $17 billion over the next four years to fund its operations.

As Figure 1 above shows, of the total operating budget, 47.9 per cent (just over $8 billion) will come from property taxes. Of all planned operating expenses by the City, about 26 per cent (roughly $4.5 billion) is expected to be collected from non-residential property taxpayers.

Historically, non-residential property tax rates have been higher than the residential tax rate. This is common practice with most cities across Canada. However, there are some exceptions, such as Winnipeg, which sets the same tax rate for residential properties as they do for non-residential properties.

How are property taxes calculated?

Step 1 – Budget deliberations

The City budget helps determine the amount of property taxes needed per year.

Step 2 – Determining how much of the budget will be extracted from property taxes

Once the budget is finalized, the property tax rate is set by Council on an annual basis. Using this tax rate, and your property value, the City determines how much each property will have to pay to cover operating costs.

Once Calgary City Council approves the budget, all other sources of revenue for the City are subtracted. These sources include sales of goods and services, license fees, permits, user fees, and grants. The amount remaining is what is left to be raised by property taxes.

Step 3 – Setting the municipal tax rates

Once this is determined, the Municipal Tax Rate (MTR) is then calculated using the formula below:

MTR = Total revenue required by the City of Calgary / Total Assessment

The split between what is paid by residential and non-residential properties is then debated by Council, which creates different rates for the property types.

Step 4 – Sending out tax bills

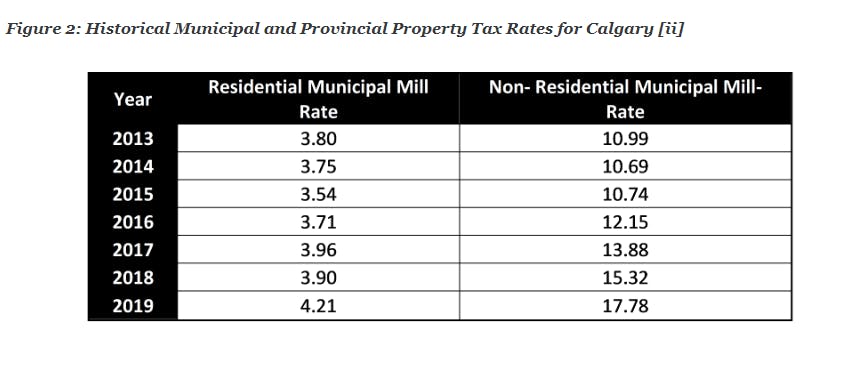

Once that’s been finalized, a property’s tax bill is then determined by multiplying the MTR by the assessed value of the property. For example, if the tax rate is set at 0.01778 per cent, this means that for every $1,000 of assessed value, that property would pay $17.78 in property taxes. This amount paid per $1,000 is also referred to as the mill-rate.

What has happened to non-residential property taxes in Calgary for the past six years?

Between 2013 and 2019, the non-residential property tax rate in Calgary rose faster than the residential rate. This was caused in part by the consolidation of the Business Tax and Non-Residential Tax, a seven-year process that involved the gradual transfer of portions of the business tax into non-residential property tax rates. Completed as of 2018, the transfer started with ten per cent transfer in 2014 and 2015, followed by 20 per cent of the business tax being added in for each year between 2016-2019.

However, while this consolidation process was underway, Calgary experienced a spike in the vacancy rate in our downtown core due to the economic downturn. Between 2015 and 2016, the vacancy rate shot up from 10.1 per cent to 18.2 per cent. This trend continued until it peaked at 24.9 per cent in 2018.

While we are projected to finish stronger in 2019 with a vacancy rate of 22.7 per cent (down from 24.9 per cent last year), the fact remains that the downtown core is nearly one quarter empty.

This high rate of vacancy has, in turn, seen assessment values for the downtown area depreciate. The decrease in assessment values created a shift of the tax burden from the high-rises in our downtown to businesses outside of the core who had to make up for the gap in the City’s operating budget. The ultimate result has been significantly higher tax bills, with some properties seeing triple digit increases in their property taxes for successive years for businesses outside of the downtown core.

In an effort to cushion the blow, the City of Calgary introduced the Phased Tax Program (PTP) for business. The PTP program, meant to be a one-time fix, was used to subsidize a portion of the non-residential property tax. And this was used consecutively in 2017, and then again in 2018 and finally in 2019. This program was not designed to be used over multiple years. Further, this program is no longer an option for 2020, as the City does not have funding for the program. Therefore, even if the City implemented the Calgary Chamber’s recommendations below into the 2020 assessment, every business’s non-residential property tax is increasing due to the end of the Phased Tax Program.

The PTP does not address the structural issues with our tax system. In fact, it costs more to administer every consecutive year it is used, as the actual tax rates accumulate year-over-year. For instance, the cost to administer the program has increased from $45 million in 2017 and 2018 to $70 million last year. This was drawn from the City’s reserve funds and Council has made it clear that drawing from the reserve to fund an increasingly ineffective program is not being considered going forward.

What does the Calgary Chamber of Commerce recommend?

Since 2017, the Chamber has been asking City Council to make long-term structural adjustments to the property tax system and to focus on driving efficiencies and reducing costs.

Early last year the Chamber made recommendations for the City to consider in order to address this ongoing issue. The cumulative effect of increasing tax burdens coupled with the absence of the PTP makes these recommendations even more imperative as the City plans its budget for 2020.

The Calgary Chamber has supported a multi-faceted approach that combines short, medium, and long-term strategies to address the structural issues with the property tax system in our city.

The three approaches are:

Reduce the non-residential to residential tax ratio to 2.8:1 by the end of the current council’s term in 2021 and commit further reductions by 2023. This must be done in conjunction with other measures to build trust that the City is operating efficiently.

Reduce the cost and increase the effectiveness of local government. While we appreciate the City making low-impact budget cuts in 2019, long term efficiencies must remain a focus. This could include privatizing services, hiring lower cost consultants, and increase operational effectiveness of administration departments.

Sale of city-owned land. Selling non-revenue generating land will increase the tax base for the City, as it does not collect property taxes from itself, increasing revenues.

Tackling the property tax issue in our city will need a focused effort using multiple levers. The Calgary Chamber appreciates that the City has been listening to the concerns of the business community. This is a problem that does not have an easy solution, and we need the City, Calgary’s business community and all citizens to continue working collaboratively to resolve it going forward.

The Calgary Chamber of Commerce will remain actively engaged on this issue. To follow along please connect with us on Twitter @CalgaryChamber, and we will provide an update at the next edition of Influence.

Sources

[i] https://www.calgary.ca/cfod/finance/Documents/Plans-Budgets-and-Financial-Reports/Plans-and-Budget-2019-2022/Service_Plans_and_Budgets_2019-2022.PDF

[ii] https://www.calgary.ca/cfod/finance/Pages/Property-Tax/Tax-Bill-and-Tax-Rate-Calculation/Historical-Tax-Rates.aspx